Deposit Reconciliation Report

The Deposit Reconciliation Report report is an extremely useful tool to help you reconcile transaction and fee details against your bank payouts - ultimately helping you check off that you have been paid out for every transaction that is processed through the POSaBIT Payments platform.

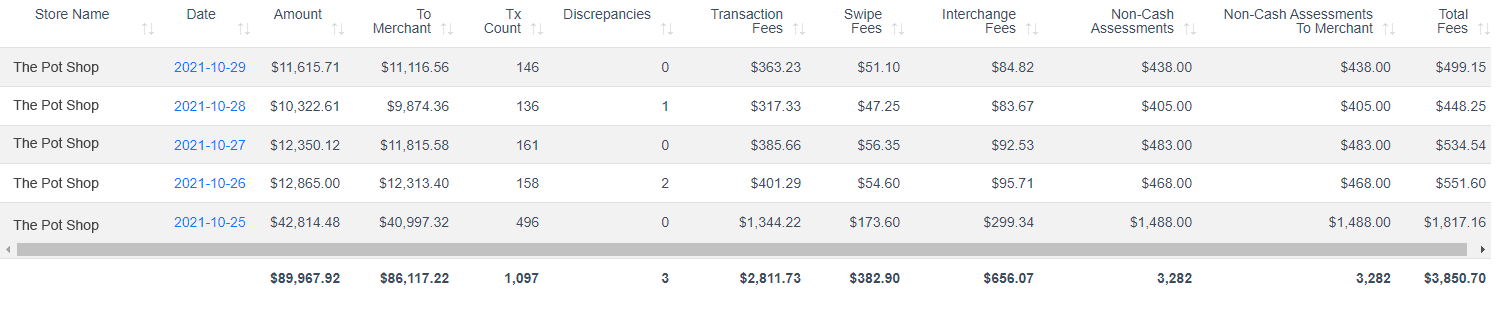

This report breaks up each deposit by row giving the user summary data of transaction totals and fees taken for each deposit. Clicking the date hyperlink will navigate the page to a page that includes additional deposit data, as well as a list of every transaction included in a given deposit.

To Access this Report:

- Login to your POSaBIT Payments portal at - https://my.posabit.com/login

- Select Reporting from the left side menu.

- Under Financial Reports select Deposit Reconciliation Report.

- Select a date range, then hit Run.

Deposit Details within this report include:

- Venue

- Deposit Initiation Date: Clickable to view a filtered-down list of transactions that made up the deposit

- Tx Count: Total amount of transactions that made up the deposit

- Total Amount: Total sales $ from transactions within the deposit before fees are applied

- Estimated Transaction Fees: Total amount $ of transaction fees from the purchases within the deposit

- Swipe Fees: Total amount $ of swipe fees from the purchases within the deposit

- Estimated Interchange Fees: Total amount $ of interchange fees from the purchases within the deposit

- Interchange %: The ratio of interchange fees compared to the total amount processed with the deposit

- Total Fees: A total of all fees that were applied to the deposit including transaction fees, swipe fees, and interchange fees

- Non-cash Assessment: Total amount $ of non-cash assessment fees that were collected from the purchases included in the deposit

- Non-Cash Assessment to Merchant: Total amount $ of non-cash assessment fees that are passed to the merchant

- Discrepancies: Count of discrepancies that were found

- To Merchant: Total $ amount that the merchant will receive (Total sales minus fees)

Below is an example screenshot of the report showing several deposits between the dates of 10/25 -> 10/29:

In addition to the overview data displayed within the deposit reconciliation report, users can also click on each "Deposit Initiation Date" to view a more detailed breakdown of the fees and transactions that went into the specific deposit. The following data can be found within the detailed breakdown of each deposit:

-

A deposit overview summary including:

- Account

- Deposit Initiation Date

- Transaction (count)

- Transactions Dates

- Deposit Amount

- Fixed Fees

- Estimated Transaction Fees

- Estimated Interchange Fees

- Total Fees

- Net Settlement

-

A table containing all transactions within the deposit with the following data for each:

- Store Name

- Total Amount

- Tip

- Purchase Amount

- Change

- POS Tender Amount

- Non-Cash Assess. To Merchant

- Date Purchased

- Payment Attempt ID

- Confirmation Code

- Buyer Name (if available)

- Billing Name (if available)

- Charge Type

- Terminal Name

- Cashier

- Fixed Trans Fee

- Trans Rate

- Calculated Trans Fee

- Net Amount

- Last four (of debit card)

- Auth Code

- Terminal Number

- Ref # (if used by venue)

- Settlement Date