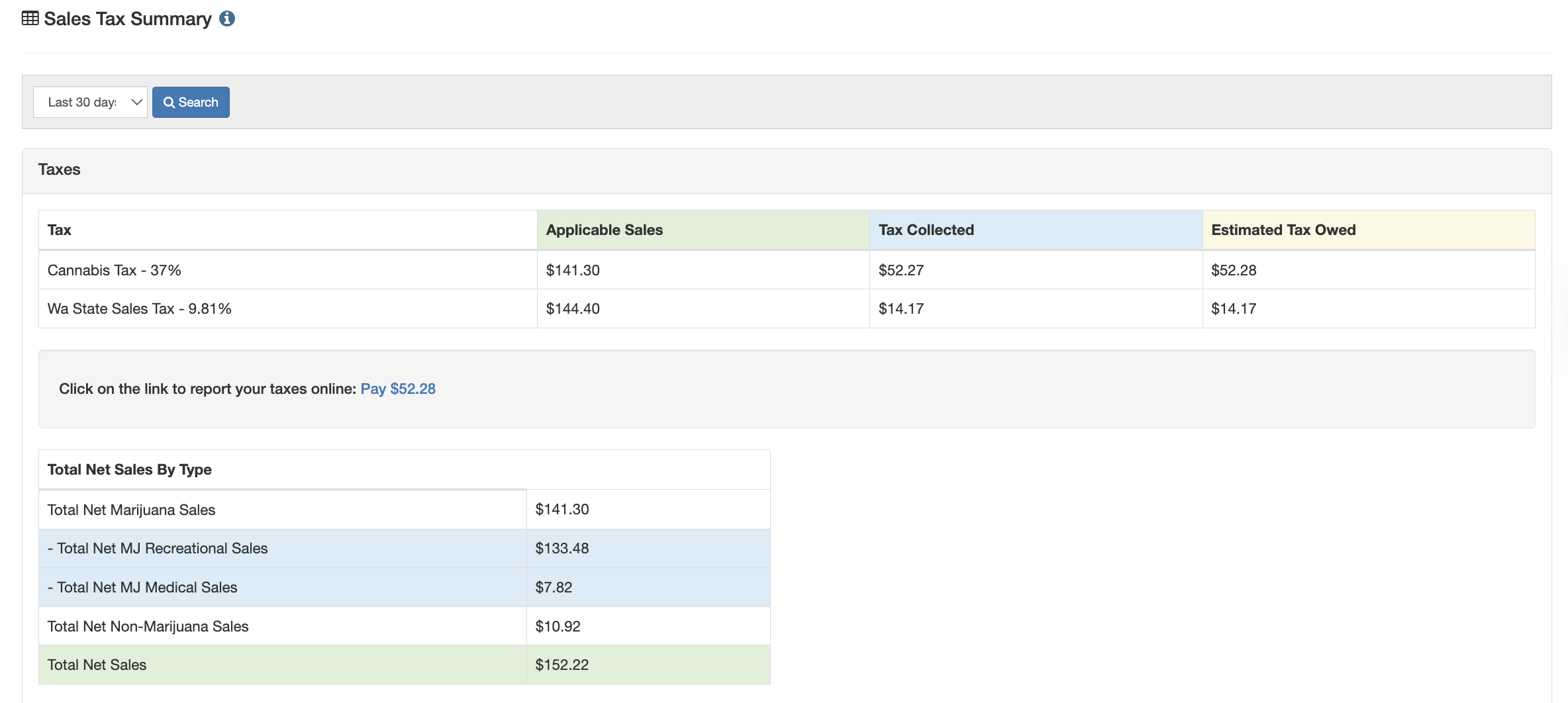

Sales Tax Summary Report

Under the Sales Tax Summary report, input a date range, and then search to generate tax totals for any given time frame. Each individual tax is broken out by:

- Applicable sales (net sales)

- Tax collected (this is the actual amount of taxes collected from sales for the defined date range)

- Tax owed (this is the estimated tax amount owed)

NOTICE: Tax collected and tax owed will always slightly differ due to pennies being rounded on transactions, throughout the course of the month. This is why taxes owed is an estimate, and should not be taken as tax advice.

When reporting taxes, you should pay the amount found under "Tax Owed". Depending on your state, if the "tax collected" and "tax owed" differ, you may need to enter the difference amount on your tax form. For example, the following image describes how tax information should be entered within Washington state (Notice field 5 is where you would enter this difference)

If you are in a state that allows you to pay your taxes online, you will find a link at the bottom of the page that navigates to your state's website to make paying taxes a breeze!

Total Net Sales by Type

Below the tax breakdown, there is also a breakdown of total net sales by type. This will show sales for the following:

- Total Net Marijuana Sales

- Total Net MJ Recreational Sales

- Total Net MJ Medical Sales

- Total Net Non-Marijuana Sales

- DOH Sale breakdown (Washington Only)

- Total Net Sales

For additional assistance please reach out to POSaBIT support @ 1 (855) POSaBIT OR SUPPORT@POSaBIT.COM